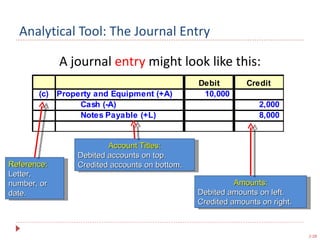

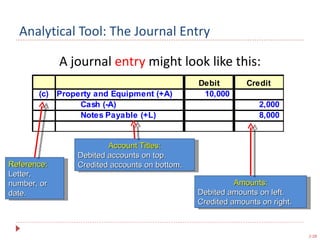

Definition:

- an accounting method for expressing the effects of a transaction on accounts

- The debited accounts are written first (on top) with the amounts recorded in the left column

- Total debits equal total credits

Accounts

| Type | Account | Dr/cr |

|---|

| Assets | | |

| Current Assets | | |

| Cash | Dr |

| Accounts Receivable | Dr |

| Inventory | Dr |

| Prepaid Expenses | Dr |

| Supplies | Dr |

| Non-current Assets | | |

| Property, Plant, and Equipment (PPE) | Dr |

| Accumulated Depreciation (Contra-Asset) | Cr |

| Intangible Assets | Dr |

| Investments | Dr |

| Liabilities | | |

| Current Liabilities | | |

| Accounts Payable | Cr |

| Salaries Payable | Cr |

| Interest Payable | Cr |

| Unearned Revenue | Cr |

| Taxes Payable | Cr |

| Non-current Liabilities | | |

| Notes Payable (Long-term) | Cr |

| Bonds Payable | Cr |

| Equity | | |

| Common Stock | Cr |

| Additional Paid-in Capital | Cr |

| Retained Earnings | Cr |

| Dividends | Dr |

| Revenue | | |

| Sales Revenue | Cr |

| Service Revenue | Cr |

| Interest Revenue | Cr |

| Gain on Sale of Assets | Cr |

| Expenses | | |

| Cost of Goods Sold (COGS) | Dr |

| Salaries Expense | Dr |

| Rent Expense | Dr |

| Utilities Expense | Dr |

| Insurance Expense | Dr |

| Depreciation Expense | Dr |

| Interest Expense | Dr |

| Loss on Sale of Assets | Dr |

| Contra-Asset Accounts | | |

| Accumulated Depreciation | Cr |

| Allowance for Doubtful Accounts | Cr |

| Contra-Revenue Accounts | | |

| Sales Returns and Allowances | Dr |

| Sales Discounts | Dr |